Does this sound familiar?

Claimer's first product:

Claim Completion Suite

Track claim progress via HMRC.

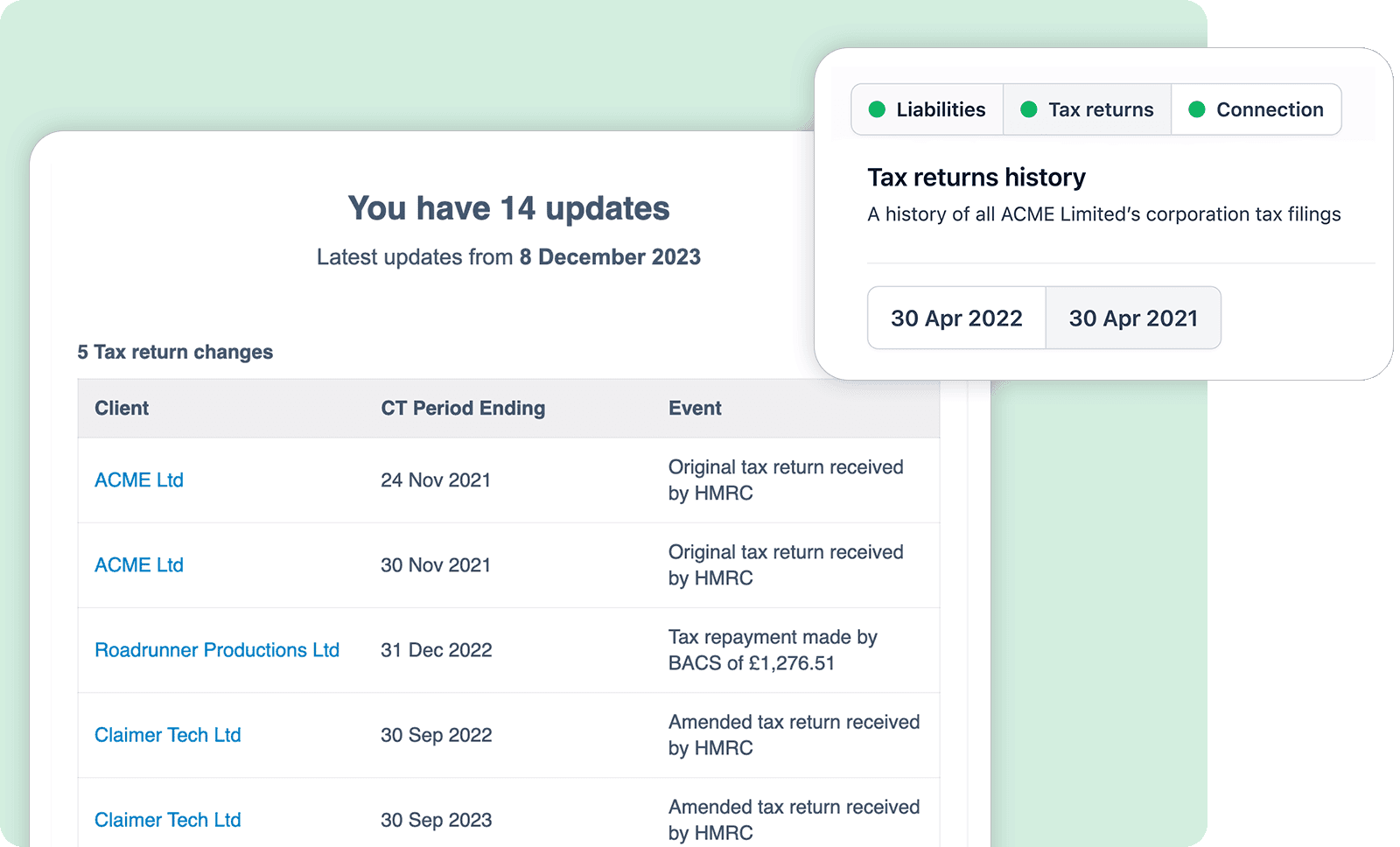

No more chasing HMRC or unexpected offsets. Keep your clients up to date on claim progress, get notified on changes to liabilities, and improve your credit control.

Get proactively notified when a claim is recieved, processed, and paid by HMRC

Keep informed with automatic tracking of underpayments across Corporation Tax, VAT, and PAYE

Easily reconcile payments with a breakdown of the tax credit, offsets, and added interest.

Integrate with your systems for all kinds of automations